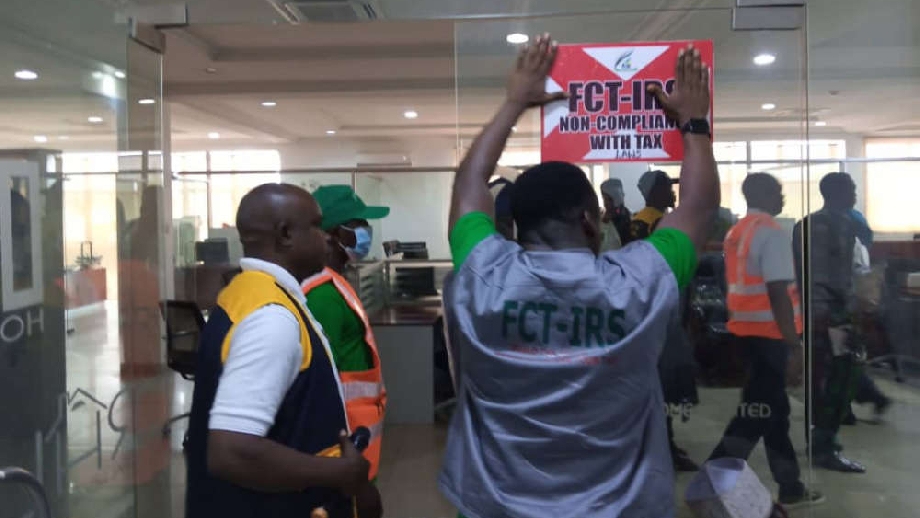

The FCT Internal Revenue Service (FCT-IRS) has sealed Regency Hotels, a school, and three businesses in the capital city for tax evasion.

The FCT-IRS acting director of legal services, Festus Tsavsar, led the enforcement team and explained that the closure of the premises was in line with a court order.

The affected school and business premises are Gratias International School, Rural and Urban Homes Ltd, Trevari International Company, and Phenomenon International Company.

Tsavsar explained that the hotel and business premises contravened FCT tax laws by refusing to file annual returns, despite several notices, including court summons.

“Today we went out to execute the court orders which ordered the FCT-IRS to seal off the premises of defaulting taxpayers brought before it,” he said.

“We have been able to effectively comply with the court order by sealing off the premises as directed.

“We went to Gratias International School, located in Games Village, Kaura, and sealed it off.

“The offense they committed was refusal to file their annual returns despite many notices, including a court summon.”

Tsavsar was concerned about the continued refusal by the school’s management to comply with the tax law, adding that the action was tax evasion, which he described as a criminal offense.

He added that the management changed the school’s name to DGIS College to evade tax payments.

“This is also a criminal offense,” he said.